Hysteresis: World oil demand peaked in 2019.

Demand for world oil, but perhaps not world energy, peaked in 2019.

Covid-19 has radically shifted the energy demand system: the concept of hysteresis notes that such a large shock will mean that, although energy demand will rebound, its shape will be permanently altered. It won’t return to its former structure.

That will push the main incumbent – oil – , into permanent decline, because the energy demand shock coincides with two emerging mega-trends: the lack of an adequate replacement to declining Chinese growth, and the fast impact of a new economic and technological peer in world road transport, electrification.

World oil demand peaked in 2019.

This is almost certain, despite contrarian views from those with deep investment in the prior normal of expected oil demand growth: national and international oil companies, oil exporting national energy agencies (eg the US EIA, OPEC), and the incumbent organising body for World Energy, the IEA. .

To see why it has peaked, we start with physics, and specifically the concept of Hysteresis.

This was a term coined by Sir James Alfred Ewing, a Scottish physicist, and engineer (1855-1935), to refer to systems that still displayed the impact of events in their history even after the actual event had passed.

The classic example described was that of magnetic fields in iron: iron maintains magnetization after it has been exposed to and then removed from a magnetic field.

A more homespun example is perhaps in phase transitions when melting and freezing temperatures do not agree.

For example, agar a jelly-like substance, melts at 85 deg C, but only re-solidifies at 30 to 40 °C. Therefore, from the temperatures of 30 to 85 °C, agar can be either solid or liquid, depending on its specific history.

In both examples – magnetism and melting point – the physical nature of the molecules and their configuration have been altered and do not revert back evenly to their original state.

After the event has come and gone the system takes time to revert, and may stay permanently altered.

The system therefore retains the “memory’ of the event – hence the word is derived from Greek meaning late, or after.

Such a phenomenon is clearly ripe for metaphor and analogy: so it became applied to other areas of study such as biology and ecology.

And also to economics.

For example labour employment.

Hysteresis has been used to explain the delayed effect of rising unemployment rates, which often continue to increase even after an economy has begun recovering after a major shock such as recession.

After such a systemic jolt, labour employment frequently never returns to its original state: companies change work structures, workers move to new jobs or retire, and consumers modify consumption patterns.

An economy can return after recession; but the precise nature of the job structure underlying often does not.

It exhibits hysteresis: the employment impact echoes long after the recession has passed.

In nature hysteresis is neutral: magnetized or non-magnetized iron is a purely objective outcome.

But in human economies there is a subjective value to a system change: it can lead to positive or negative outcomes.

A change occurs and it may usher in new high-growth jobs that outnumber the low-growth maturing ones, or the change may force long-term job decline if the work-force cannot re-skill or recover. The dot-com era probably still divides opinion.

But if the change is universally assessed as negative to the economy, such as in a recession or pandemic, hysteresis predicts that the negative effects will lag any removal of the change, and perhaps be profound. Agar melted to 85 deg C and then held at 60 deg C will never return to a solid state.

Analysts looking for V-shaped, or L-shaped or Nike-swoosh type returns to economic growth are therefore invoking hysteresis: they are attempting to predict the precise shape of the hysteresis effect: quick return to earlier state, no-return, or delayed return.

And so to oil demand.

A First Law Of Hysteresis and Oil Demand

Whilst nature is neutral to its actions, human beings are not.

They have a bias in their interpretations of natural events.

A first economic law of hysteresis might be stated as: the more vested a party is in the prior system, the more likely they are to state that the hysteresis lag will be short and limited.

They desire the prior system to return quickly and unspoiled.

In analytical terms they will have a large personal bias toward a “V-shaped” style of hysteresis: short time lag, quick return to former state with little change.

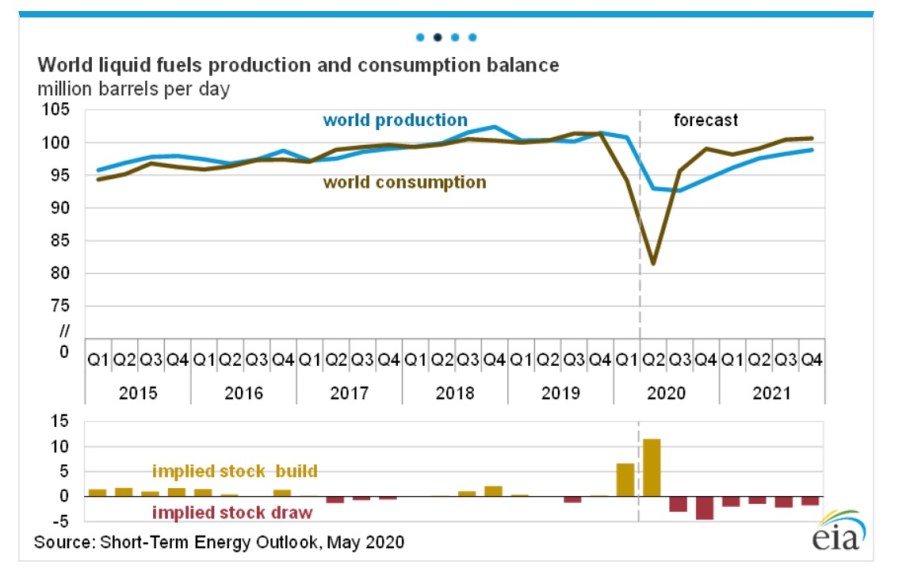

In oil demand, we can see this effect in the predictions of the incumbent corporations to the impact of the Covid-19 global pandemic: the IEA and EIA for example both predict an almost break-neck, short-lag V -shaped hysteresis effect.

Both accept that oil demand this year will fall by likely 10% or about 10 million barrels/day, reversing demand to levels last seen in 2012.

However, they both believe that this demand shock will fully reverse in 2021, with demand back, unsullied, to 2019 levels in the space of 12 months.

Historical data disagrees.

Panning out a a bit from the EIA’s five-year window, in the most recent economic shock the so-called “great recession” of 2008, oil demand fell about 2% between 2008 and 2009, and took about 2 years to recover.

It would be weak analysis to just assume that a 10% effect might take 10 years to recover: however, the onus must be on the V-shape oil demand recovery enthusiasts to explain why a financial crises at a time of robust underlying oil demand growth – which caused a 2-3 year hysteresis lag – would be more acute than a global pandemic which hit when oil demand was already under stress.

For example OPEC and other major oil exporters have had to co-ordinate production cuts for almost 4 years beginning in 2016 to deal with chronic demand decline.

So how do the EIA and also the IEA justify this instant rebound?

In its latest assessment the IEA highlights urbanisation in India and Africa.

And in pre-Covid times it also pointed to the engines of petrochemicals and aviation fuel demand that would be in the vanguard of new oil consumption.

Let’s take these three sub-sectors of oil demand in turn.

India and African Oil Demand

Can India and Africa fill the demand gap that Chinese growth filled in 2007-2008.

Source BP

The short answer is : No, there is only one China.

China consumes one in every seven barrels globally.

India is a large user of oil, but it is not China: it consumes about a third of Chinese demand and at a lower growth rate.

African oil demand growth was in fact negative pre-Covid in 2018, and only accounts for 4% global demand, at a growth rate that is 50% lower than China.

Petrochemicals

The IEA and IOCs have often looked to plastics as the “great replacer” of oil demand for road fuels.

It is true petrochemicals command a solid growth rate of ca 4% pa, which is far higher than the 1% pa growth of transport fuels.

But they also only constitute about 8% of the oil barrel, and have to compete with cheap gas as a competitor feedstock.

Perhaps post-Covid demand for PPE and hand sanitiser will boost this growth rate; equally, dematerialisation in the form of digital menus and hotel keys and so on may move growth the other way.

In any event, hinging demand sustainability or recovery on plastics was always a strained endeavour.

Aviation Fuels

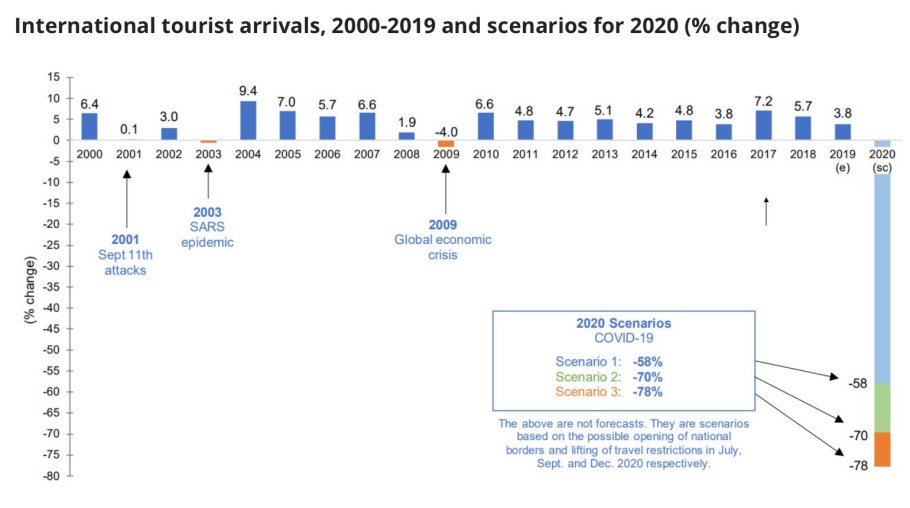

Accounting for the same amount of global demand as petrochemicals (8%), aviation fuels consumption has collapsed by between 60-80%.

source UNWTO

Of all the components of the oil barrel, aviation fuel is likely to exhibit a very strong hysteresis effect: a long lag of behavioural change in air travel, especially international, disintegrating the demand of its primary product Jet A1 kerosene.

The comparison, again with 2008-09 is striking – that was a short-lived drop of 4%; the latest estimates of airline travel change are up to 20 times more negative than that impact.

The Demand Elephant

But the biggest problems of the encumber V-shaped arguments is that they avoid the demand elephant in the room – road transport.

Road fuel demand accounts for about 45% of total oil consumption, and a majority of its demand growth.

One level down the US accounts for about 25% of global transport fuel demand.

And as it turns out, road transport is also very sensitive to external shocks, bound up in individual choices, and so exhibits a strong hysteresis effect.

In the “great recession” of 2008 US road transport as measured by vehicle miles travelled (VMT) dropped by 5%, and then took 7 years to return to its previous peak. The picture in the US in 2020 is of a different order.

source Brookings

US gasoline consumption had already peaked somewhere between 2016 and 2017, well ahead of Covid-19 – due to a mixture of improving fuel economy and electrification absorbing marginal growth (hence ahead of the gross VMT peak which may well be 2019 – see above).

So far in 2020 the miles travelled have dropped by 20%, a value persisting into the summer driving season.

At a stroke this takes almost 2 million barrels/ day on an annual basis from the world oil demand system.

And to all of this, bad enough, we can add in the rapid rise of the electric transport phenomenon (EVs) – the first time that road transport fuels based on oil have had to compete at global scale with an economic and technological peer in over 100 years.

So, of course VMT will rebound: but if 2008-2009 is any guide, that may take a decade or more, by which time many of those miles, perhaps as much as 25% or more, will be electric-powered.

To put in perspective this drop in the US road transport demand – alone – is over double the growth total of Indian, African and world petrochemical demand – even assuming they had no Covid-19 to contend with.

Factor in aviation fuel demand collapse, and the situation just gets worse.

2019 – Peak Oil: Now What ?

Thus – we sit at a peak of global oil demand.

This is not a political statement, but a flat arithmetical fact: historic spreadsheets will show that the round number of 100 million barrels/day was the world oil demand peak in some month of 2019.

There will be no “V-shaped” reversion to the previous form: historical data supports a very different outcome.

Instead the incumbent fossil fuel system will be slow to revert, and will be a more deficient form of itself, fending off high-growth competitors, and having to deal with policies to limits its role in CO2 emissions and climate change.

But let’s be clear – peak oil demand is not peak energy demand. That remains to be seen, as the mega-trends of population growth and energy efficiency from electrification work in tension.

But it is peak demand for the specific type of energy system that is currently dominant.

Fossil fuels will now form a declining role in the altered system; demand patterns are changed forever.

We will move to a new energy system.

That new system was already emerging pre-Covid: more electrified, more scalable and manufactured, perhaps now also more individualised and private, and it will occur more quickly replacing the limitations of the previous fossil-fuel structure.

What comes next will therefore not be the same as the current energy system.

That system has been permanently reshaped: and it will reveal that history gradually via hysteresis.

Beginning with a post-Covid long-term decline.

————- ![]() ————-

————-