From OPEC to Skolstrejk: How Technology and Memes are Changing Energy

Energy is Evolving Quickly

“Don’t be afraid of a little metaphor; it won’t bite you, but you should always make sure you know how to cash it in for unvarnished fact when you feel the urge.” Daniel Dennett

Like oil price predictions, one should use Darwinian analogies or metaphors when analysing the oil industry with deep trepidation and caution.

As Daniel Dennett notes in his excellent work, From Bacteria to Bach and Back, which this post leans on heavily, we have to make sure we know when to cash our metaphors in for unvarnished facts.

So, with that health warning (and the fact as the link above shows his work remains controversial) let’s embark on looking at the oil industry transition through a Darwinian, evolutionary approach.

First a long extract from the work (see especially Chapter 7).

Dennett quotes the clearest summary of evolution he is aware of, from Peter Godfrey-Smith, a philosopher of biology:

“ Evolution by natural selection is a change in a population due to:

(i) variation in the characteristics of members in the population,

(ii) which causes different rates of reproduction, and

(iii) which is heritable”

Dennett goes on to take this biological assessment further:

“Whenever all three factors are present, evolution by natural selection is the inevitable result, whether the population is organisms, viruses, computer programs, words or some other variety of things that generate copies of themselves, one way or another.

We can put it anachronistically by saying Darwin discovered the fundamental algorithm of evolution by natural selection, an abstract structure that can be implemented or “realized” in different materials or media.”

Godfrey-Smith developed his three-point summary further by creating “Darwinian Spaces”, a three-dimensional depiction of his criteria.

By developing this model he was able to highlight differences between Darwinian phenomena, and quasi-Darwinian phenomena (“sorta-Darwininan”).

In the model, exhibiting all three phenomena is Paradigmatic Darwinian evolution; but there are intermediate and trade-off cases that also inform why certain traits arise or species die out.

Fundamentally this helps to explain, as Darwin himself did, that the ancient theory of essentialism, which claimed things or species just happen to have stable essences or correct characteristics, was wrong.

Instead Darwin created Darwinism: the idea that species are connected by gradual variations so there was no principled way of drawing a straight hard line and saying, for example, “dinosaurs to the left, birds to the right”.

Godfrey—Smith’s original chart is shown below.

In his framework, the axes range from 0 to 1 and the (1,1,1) location is the purest Darwinian evolution: the Paradigm, or perfect standard, in terms of the evolutionary process.

One of the key issues where the Spaces concept is useful is noting that efficient evolution – a gradual, uncomprehending, bottom’s up process – relies heavily on the (z) axis: a smooth, ordered and relatively unchanging landscape.

If the landscape is “rugged”, prone to major shifts in shape and outline, then evolution is next to impossible.

Blind luck can take over (and over again), and stop incremental improvements from taking hold: which is why evolution likely took so long to, as it were, evolve.

As the Earth’s early environment took shape, oxygen levels, temperature and so on were in wild flux. Micro-adaptations to a given set of conditions could be rendered useless when for example planetary bio-chemistry “suddenly” changed.

Sudden is relative. Such planet-wide shifts might take millennia. But so does evolution.

Which is where, perhaps, application to the energy transition comes in.

We can use this framework to show how the energy transition may not be simply a case of fossil fuels to the left of a line and wind / solar to the right.

The transition is likely to follow a more gradual process of energy sources transforming from one to the other over time – with hybrids and combined variants along the way.

So what is forcing this energy transition?

The need for energy is not disappearing, but our way of using it or demanding could shift the way in which energy is created and distributed.

Suppose the landscape for dominant energy companies suddenly changed in terms of competitive advantage – becoming more rugged all of a sudden after many decades of predictability.

Of course we could cash in our metaphor now for facts, and state that oil companies are not blindly-mutating organisms, or abstracts such as words, and that if the landscape around them changed dramatically, then they would “adapt”.

But not in the Darwinian sense.

Such adaptation – a new business strategy – would in theory at least be a top-down, directed, comprehending adaptation, the anti-thesis of the actual Darwinian process (bottoms-up, random, uncomprehending).

This is Dennett’s overall view: that human culture started out as Darwinian: but de-Darwinized by becoming more comprehending, more capable of top-down organization, with more rules and structure.

A pinnacle – paradigm – of this being the modern corporation.

But perhaps there is a hybrid way of looking at this Darwinian Space.

Yes, modern corporations are (typically) non-Darwinian creatures: comprehending, top-down entities.

But in long-cycle industries, such as thermal energy, they may have become somewhat bottom-up once more, working to expected landscapes, and ritual ways of behaving.

In a sense re-Darwinizing.

This becomes a big problem if their (business) environment suddenly changes, undermining all the various ways in which they had adapted to the previous level landscape.

Of course biological evolution takes a long time to play out: but cultural evolution, a similar process, as Dennett defends in his work, can be far far quicker.

Dennett plays with Darwinian Spaces to include cultural elements in this variant of the original (nb intelligent design in lower case).

As Dennett notes, much of Darwinian and non-Darwinian growth or reproduction is actually in the middle areas, full of compromises.

This starts to blend the concept of cultural reproduction or growth via memes – units of cultural transmission – with the more common concept of biological genes.

Clearly , for example, words or strong ideas are different from say viruses – but in Dennett’s analysis only on an axis of cultural versus genetic reproduction.

Let’s resist the temptation to cash in here and continue with the metaphor and the changing energy environment.

Oil companies are corporate bodies designed to achieve excellence in a few key areas such oil extraction and production.

These corporations can be driven by a small set of very strong “memes” or cultural statements or beliefs that hold strategic power and often result in uncomprehending imitation.

In oil and gas these can stretch across many companies: for example “monetize gas”, “advantaged feedstocks”, “integrated assets” and especially “economies of scale”.

The latter is still an article of faith for thermal based extraction companies: when the dominant paradigm is large-scale extraction with long-lead times to recover capital, the dominant companies are those with large reserves, or lots of capital and preferably both.

Dominant thermal oil companies therefore have evolved to look and act very very big: Aramco, Exxon, Shell, BP and so on.

But the memes are more than slogans: as Dennett notes, they can be used to define a culture, get widely imitated and replicated and so set directions for corporations or indeed nations or religions.

Often consultants and analysts will plot oil and gas strategic competitiveness on 2×2 (2-dimensional) matrices that show such strengths.

The long-term paradigm, or global leadership, for the oil industry has been OPEC: it has access to giant oil reserves and so production capacity, combined with low extraction costs.

If we plot these two elements – large production capacity and low-cost production costs – OPEC – the cartel of major large national oil producers – always appears at the top right of any 2×2 matrix: the (1,1) paradigm in Godfrey-Smith terms.

Others feature on the chart.

International oil companies do not have OPEC’s natural endowments of oil reserves, but they have capital and production scale via technology.

Equally, smaller national oil companies (NOCs) or niche oil companies with specific local strengths can survive assuming certain oil prices.

Oil companies without resources and efficient capital were – usually – removed from the landscape.

Now suppose the environment shifted substantially, and as in Dennett’s culture diagram incumbent firms did not respond in a fully comprehending way – ie they responded more Darwinially – in incrementally competent, but not comprehending fashion.

That is they chose to only continue to incrementally improve their standard ways of working, but were unable to reinvent themselves for the new landscape, or were just uncomprehending of how large the change actually was.

Such a shift, and reaction, seems to have happened around 2010 – with three major jolts to the energy landscape: shale scalability, energy manufacturing and environmental stress.

These changes, at least initially, generated only a limited response from the dominant firms of the old environment – as they held to the dominant paradigm and memes of the previous landscape.

Lets look at those three landscape shifts in more detail.

1 – Extraction Scalability – US Shale

National oil companies such as OPEC have large reserves, exclusively-owned, and can afford to site large structures on them to extract and produce oil.

International oil firms can only do this where reserves are large, and deploy large customized extraction and production units such as offshore oil platforms or huge LNG plants.

These plants are essentially one-off, huge long-term bets on capital – until oil or gas is produced (a time-frame typically of 5-10 years) no revenue was received.

US shale production and investment in 2010 was marginal: < 4% of the global total.

But by 2018 it has become 25% global investment and almost 10% production, continuing to grow.

The key element here is scalability: both in terms of engineering and financing.

To the classic elements of economic size and reserves, US shale added the ability to scale up and down quickly in terms of production and investments: manufacturing-style horizontal well-fracking allowed production scalability, and deep financial markets allowed financial flexibility via hedging and other instruments.

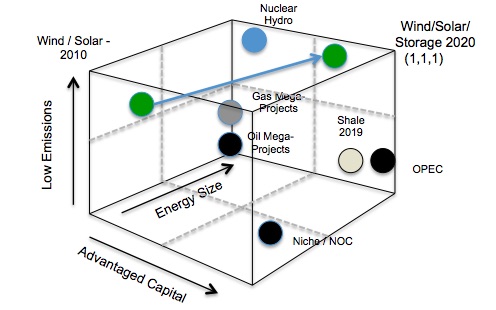

The design space chart below indicates how the landscape changed for oil and gas over this time – and also why incumbent firms were slow to react.

This type of production was a new paradigm: OPEC held to their dominant paradigm because it still worked to an extent, and they had limited options; international oil firms remained fixed on size and technological complexity as they were committed to these for long-term targets. And cultural memes such as competitive advantage via excellence in engineering still held dominance inside corporate walls.

As such neither IOCs oe OPEC participated (significantly) in the new production model, nor saw it as much of a threat as it did not adhere to their paradigm view.

Both types of firms are still very much around, despite the rise of shale, but forward-looking share prices and oil market prices tell a story of borrowed time for incumbents who seem unable and / or unwilling to change. The rise of shale, bringing over 6-7 mboed of new oil supply to the global markets is forcing the industry to adapt.

OPEC is now reacting to the new paradigm by curtailing its own production to prop up prices. IOCs are latterly absorbing US shale companies or divisions to add to their portfolios.

2 – Zero Carbon Technology (at Global Scale)

The next major shift has been the growth of non-fossil fuel technologies.

This has created a new taxonomic class of energy system, not just a more efficient genus or species.

(Large-scale) energy has now branched off in evolutionary terms from extraction to manufacture: it’s as profound a move as that dinosaur to bird evolution Dennett described earlier. (And no, still not cashing in yet).

Whilst this is also due in part to scalability, and policies for lower CO2 emission, a major driver has been the distributed, solid-state manufactured nature of especially solar and wind and large-scale battery power.

Whilst shale could point to scalable production as a major new evolutionary trick, wind, solar and batteries could point to a whole new model of energy production: manufactured units converting infinite sources of renewable energy (light photons and air) into heat, mobility and light via electricity.

But for wind and solar the key difference with shale is that they produce zero emissions.

On a 3D Darwin Space this demotes shale to the same zone as OPEC – effective capital usage, but CO2-emitting.

The new standard is wind and solar, who are also reaching capital and size levels of the large oil producers. Both as individual firms, and as an aggregate, distributed industry.

Note this also differentiates them as shown from historic emission-free technologies such as nuclear and hydro.

This remains a blind spot to large oil and gas companies: the new algorithm for energy is not large fossil fuel extraction and combustion, but manufactured, distributed conversion technologies based on electricity.

These first two landscape transformations are substantial enough, but they are now aligned with a further major shift – climate change.

Or more specifically a growing wider concern on climate stress, that is now as much cultural as technical.

3 – Climate Stress – The Transition Becomes Memetic as well as Technological

Up until last year perhaps the symbols or key memes of the energy transition were Tesla, or solar panels or wind turbines, or even batteries. Technical and industrial emblems.

Now, equally dominant as memes are abbreviations such as GND (and AOC) and foreign phrases such as Skolstrejk for klimatet.

In fact the notion of climate change has morphed from global warming, to change and now to climate stress, a wider phenomenon focussed not only on fossil fuels emissions, but eg urban air quality and plastic consumption and waste.

It can be argued that this is captured already in the zero-emission and electrical nature of wind and solar – but the climate focus is more a cultural meme that is already being used to drive wider energy change – or indeed resist it by suggesting it’s motives are political and not scientific.

This latest element of the energy transition is therefore more cultural and transmitted not only at a technical industrial level, but increasingly at the consumer and political one.

The phasing out of conventional internal combustion engine vehicles across a wide number of major global cities is driven in part by health quality issues as well as climate stress.

And whilst petrochemicals for example are a modest part of overall energy consumption, they have a very high profile for environmental stress too leading to increasing numbers of restrictions on the use of certain types of thermoplastics based on oil feedstocks.

Put together all of these changes have created a new algorithm for evolutionary success in energy: to succeed in the future energy environment, energy should be:

• Manufactured, scalable, efficient and distributed

• Aligned with electrical applications and innovations

• And providing low environmental stress

This now puts OPEC and other oil firms as the anti-paradigm: single-sited, extraction-based, focused only on thermal transport, with high impact via CO2 emissions on the climate and more general environmental health quality.

Even more efficient fossil fuel sectors such as shale or petrochemicals fail on most of these dimensions: even zero-emissions technologies such as hydro and nuclear do too.

Only wind, solar and battery storage emerge as likely successful candidates for evolutionary success in the long-term future of energy production.

Let’s remind ourselves of Godfrey-Smith’s summary of evolution:

“ Evolution by natural selection is a change in a population due to:

(i) variation in the characteristics of members in the population,

(ii) which causes different rates of reproduction, and

(iii) which is heritable”

A major shift in the energy landscape has created new types of energy producers – large scale manufacturers – who are rapidly finding new energy applications – especially via electricity – at a rising rate. These new producers are also aided by the cultural shift toward zero-emissions technologies and environmental stress concerns.

The energy industry landscape has changed substantially in just a few years, and the type of company likely to emerge in this landscape will not be the large, integrated, mining-extraction-construction paradigms of the past.

They will be the anti-thesis: more globally distributed with manufacturing expertise, aligned with electricity’s growing applications, perhaps smaller scale to begin with, and constantly placing emphasis on low environmental stress.

Note – based on analysis by Gregor Macdonald.

Let’s cash out the metaphor here for fact.

Despite much lauded investments in “renewables” big oil firms today still only spend 1.3% of their capital in this area: the dominant memes of high capital spend in core business (98.7%) remain ascendant.

They have chosen to stay with the adaptations that have served them well across the long past.

But from almost zero contribution to global energy in 2010, shale is over 8% global oil production and wind solar and batteries now produce account for 15% of global power capacity: and add to this that wind, solar and batteries are still growing rapidly in deployment; with wind at 10% pa and solar 24%.

Together both these new arrivals already account for 5% global primary energy consumption, absorbing the majority of growth in global energy in both transport and power.

The new energy landscape is undermining those firms best adapted to the previous one.

And not at the pace of biological evolution, but now at the pace of cultural evolution which can be almost instant.

————- ![]() ————-

————-